Company Information

Ask for more detail from the seller

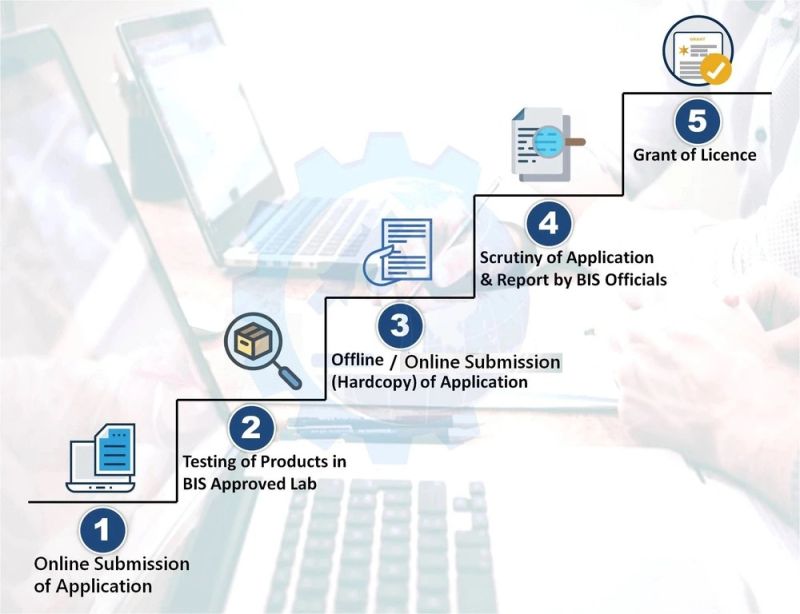

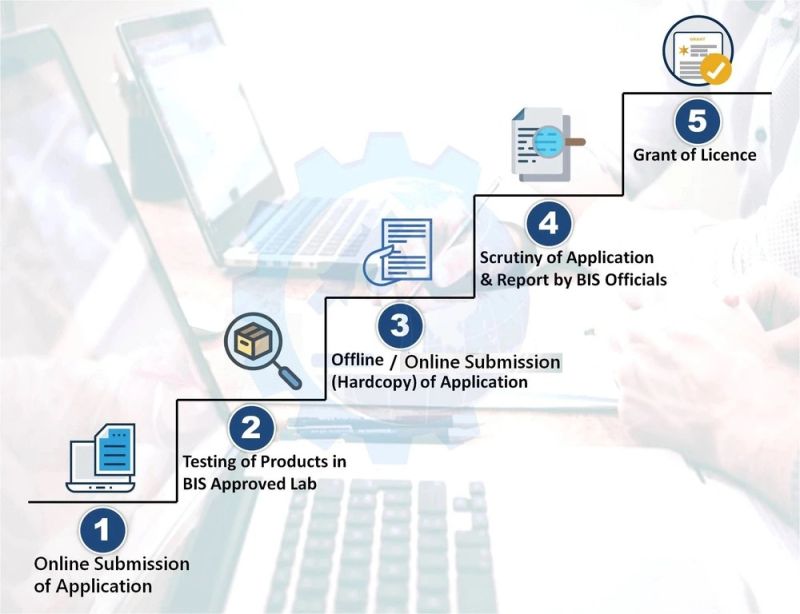

Contact SupplierAutomatic Teller cash dispensing Machine is also known as the ATM, which helps customers of a financial institution or bank to perform various functions like cash withdrawal, take transaction statement, fund transfer, account details, change pin, etc. It performs half of the tasks of bank officials and customers. The best thing about ATM is that it saves time and works 24*7. At any time, needy customers can withdraw money. The modern ATM is designed in such a manner that anyone can operate like an illiterate individual and specially-abled person. In short, ATMs are useful because they allow customers to execute rapid self-service activities such as deposits, cash withdrawals, bill payments, and account transfers. On 01 April 2021, the Bureau of Indian Standards (BIS) has required the Automatic Teller Cash Dispensing Machines to be registered as per IS 13252: 2010 under the Compulsory Registration Scheme from BIS. As we are all aware, day by day, cybercrime is increasing. Keeping this in consideration, BIS has certain guidelines for ATMs in order to reduce these crimes. Recently the Government of India and BIS have taken this step to maintain the quality of ATMs.