Company Information

Ask for more detail from the seller

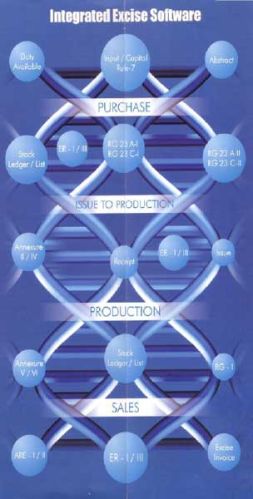

Contact SupplierWe are offering excise software . Updated with education cess, s & h cess

an option of daily / monthly posting calculation of excise duty on the basis of mrp / abatement / pro-rata / deemed credit

progressive calculation (considering branded / unbranded / without export value) posting of sales return entry to rg 23a part I & ii

differential rate invoice entry

percentage of excise duty linked with progressive amount

user definable percentage of excise duty (e.g. 9.6% to 16%)

auto bom (bill of material)

loan & license part-wise page number generation

different excise duty consideration like bed, aed (gsi), sed, nccd, aed (t & ta), education cess in invoice, rg 23 a part ii, er ii and er iii

data security through mirror image and encrypted form of backup option

user-wise entry level security

front office documents:

excise invoice (with / without progressive amount)

daily input to production slip daily output from production slip tr-6 challan annexure 22 for captive use

registers:

personal ledger account (pla)

personal ledger account (pla) with education cess

rg 23 a part I (item-wise/date-wise/group-wise) for raw material / capital goods

rg 23 a part ii for raw material / capital goods

input service tax credit register with education cess rg I (item-wise/group-wise/chapter-wise) daily stock statement duty payable report (date-wise / invoice-wise / chapter-wise / group-wise) duty available report deemed credit availed report daily production report captive use stock ledger report form iv for stock of raw material form rt v for raw material used & finished goods produced duty deposited under tr-6 challan

er I (rt 12) reports:

er- I (monthly return for production and removal of goods and other relevant particulars and cenvat credit) er- I weekly er- iii submitted by the assessee falling under provision to rule 12 (quarterly returns) er-v and er-vi abstract of input goods & capital goods under rule 7.